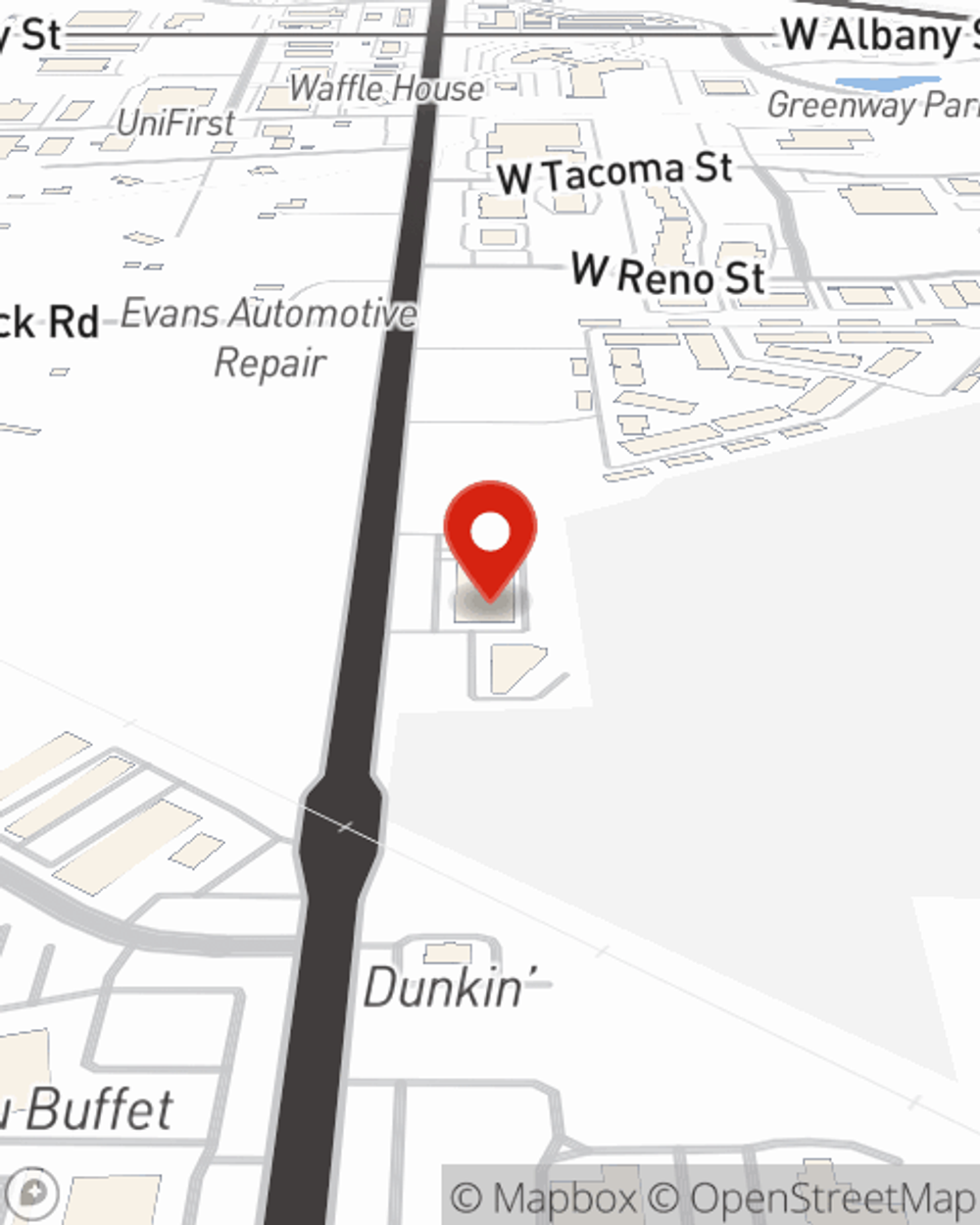

Business Insurance in and around Broken Arrow

One of Broken Arrow’s top choices for small business insurance.

No funny business here

Cost Effective Insurance For Your Business.

Operating your small business takes effort, commitment, and outstanding insurance. That's why State Farm offers coverage options like business continuity plans, extra liability coverage, a surety or fidelity bond, and more!

One of Broken Arrow’s top choices for small business insurance.

No funny business here

Customizable Coverage For Your Business

Whether you own an ice cream shop, a lawn care service or a donut shop, State Farm is here to help. Aside from exceptional service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Blackie Gibson is here to review your business insurance options with you. Reach out Blackie Gibson today!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Blackie Gibson

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.