Homeowners Insurance in and around Broken Arrow

Protect what's important from disaster.

Help cover your home

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

It's so good to be home, especially when your home is covered by State Farm. You never have to be uneasy about the unpredictable with this outstanding insurance.

Protect what's important from disaster.

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

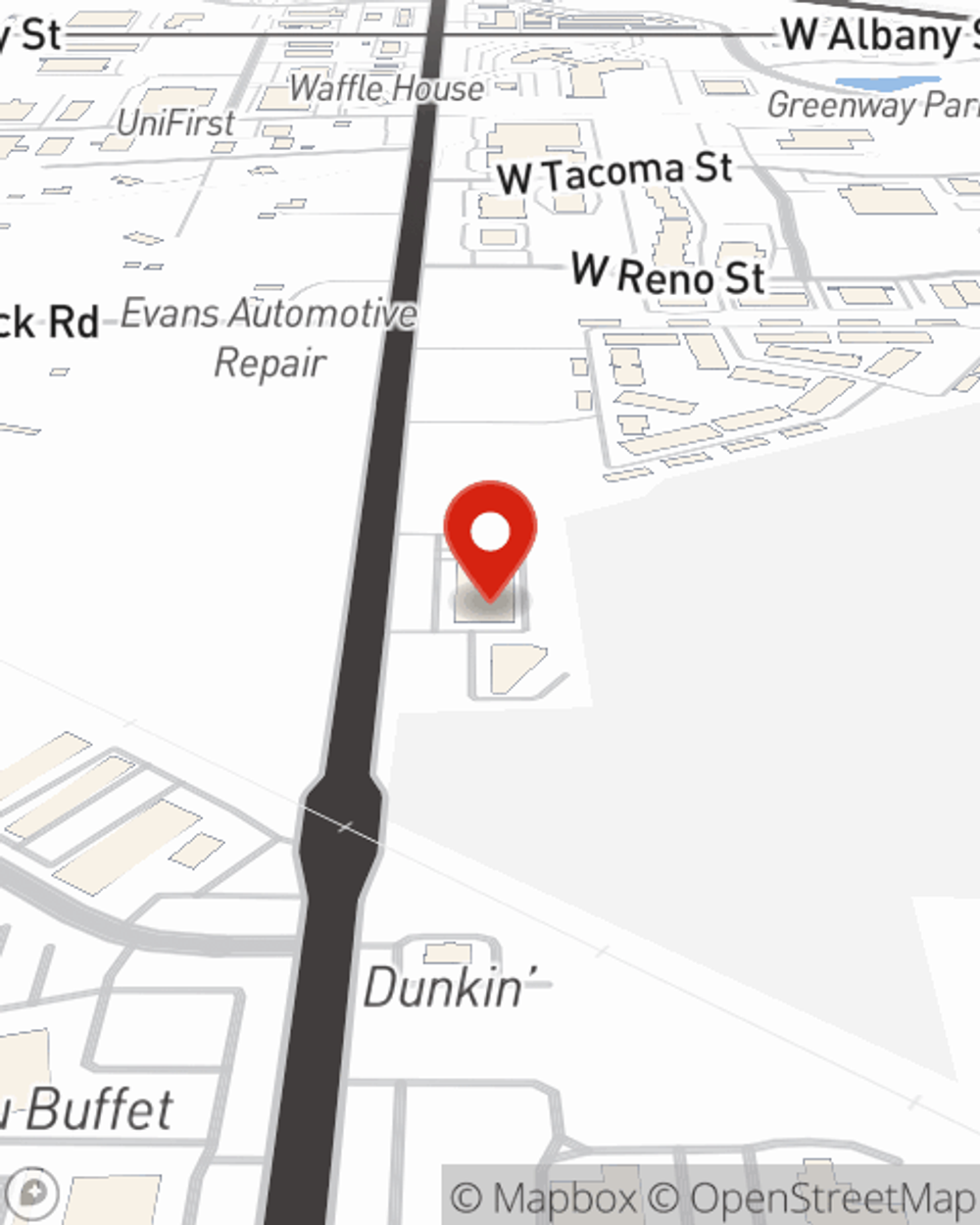

Outstanding coverage like this is why Broken Arrow homeowners choose State Farm insurance. State Farm Agent Blackie Gibson can offer coverage options for the level of coverage you have in mind. If troubles like wind and hail damage, drain backups or sewer backups find you, Agent Blackie Gibson can be there to help you file your claim.

Broken Arrow, OK, it's time to open the door to great protection for your home. State Farm agent Blackie Gibson is here to assist you in creating your plan. Contact today!

Have More Questions About Homeowners Insurance?

Call Blackie at (918) 258-5565 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pet hazards

Pet hazards

If you take a look around your space, you will likely find household items dangerous for dogs & things toxic to cats. Help protect your pet with these tips.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Blackie Gibson

State Farm® Insurance AgentSimple Insights®

Pet hazards

Pet hazards

If you take a look around your space, you will likely find household items dangerous for dogs & things toxic to cats. Help protect your pet with these tips.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.